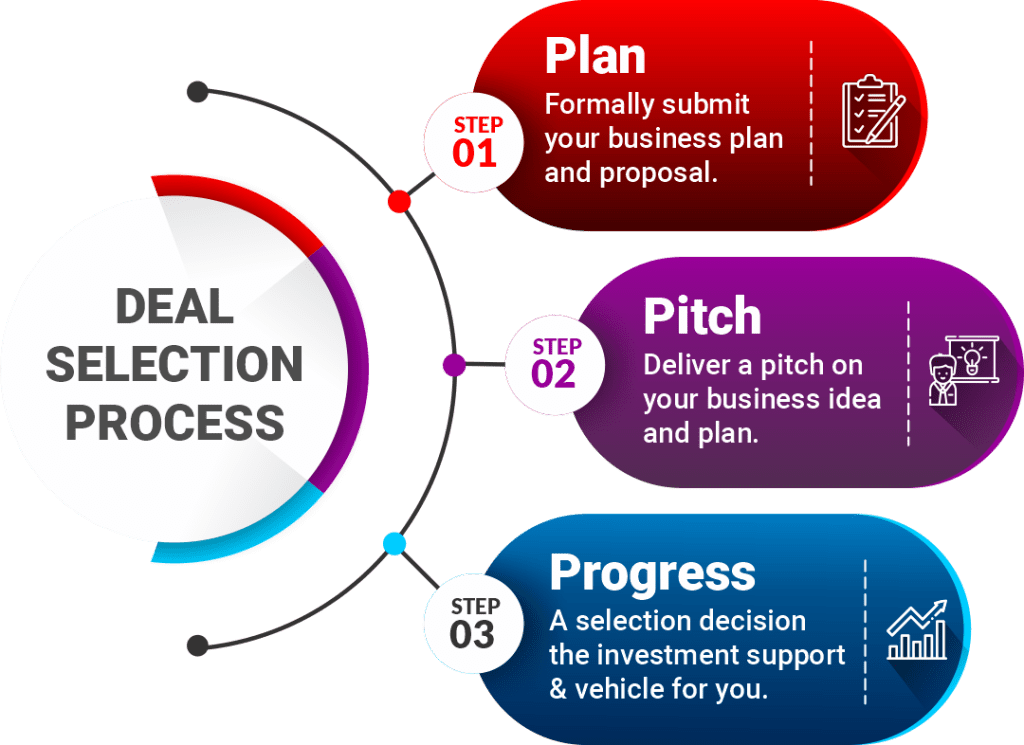

To submit a pitch deck or discuss working with us in our core incubation offerings and support areas, please contact us.

We are a specialists organization focused in finding, nurturing, funding and helping establish new or young starts-ups in our niche focus sectors or industries. Typically, our approach embraces mid to long term view of investing, often taking on new businesses with steady but positive growth opportunities and outlook.

The unique segment requires specialized care and interventions that can be best provided using structured interventions that approach each requirements.

The people and ventures we support have spent a lot of time conceptualizing their business, building the models, defining the strategy, and testing their business ideas. Our support is often the last mile to opening their doors to customers, or the important boost that helps them stay afloat, one stage to another. We invest in edutech, fintech, hitech, real estate value chain, and logistics.

A Delaware US based fund into which Incubenta invested, and they specialize in early-stage startup funding, combining Angel-investor approaches for supporting tech start-ups and new businesses, with special emphasis in commerce enabling technologies like Fintech, InsureTech, HealthTech, EduTech, SaaS, eCommerce, eMarketplace any commerce that uses technology to scale.

Advisory Board Member

Director

Advisory Board Member

Non-Executive Director

Our involvement criteria include some or all of the following:

Your business can be pre-seed or a running business with an

A running business generating recurring revenues and less than 5 years old

We will prioritize engagement and support for

We discovered after various studies over the years that many tech startups fail because they don’t get sales and marketing right, even with game-changing technologies. So we set-up an aspect of what we do to address this.

We value sustainability, being socially responsible, and ethical considerations in selecting the businesses we invest in.